mPOS

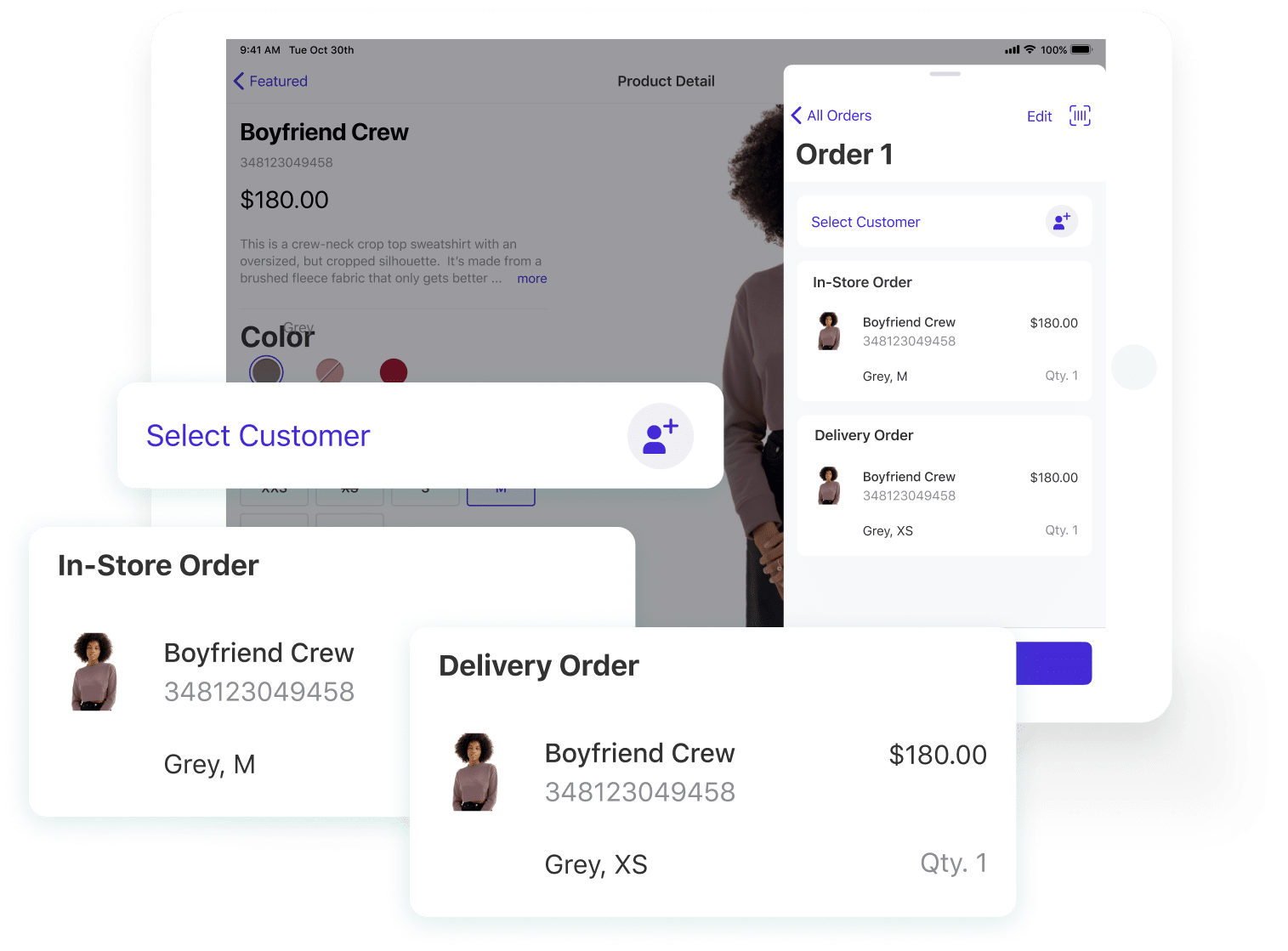

Eliminate the checkout line with mobile point of sale

Omnichannel shopping shouldn’t be tied to a fixed till. Tulip’s mPOS lets associates access ecommerce inventory and transact from anywhere in the store.

Trusted by the best

Background

The modern store needs flow and flexibility

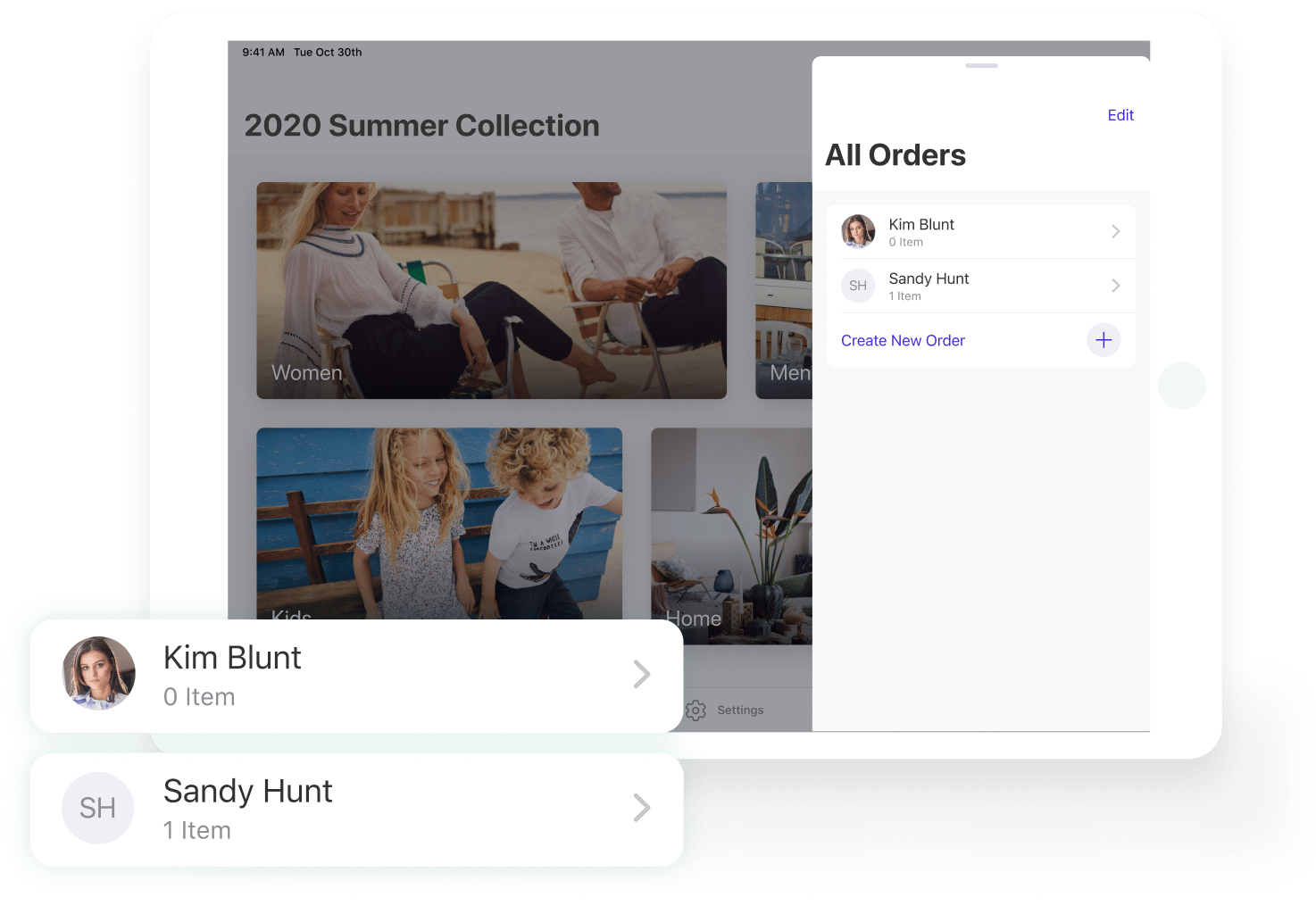

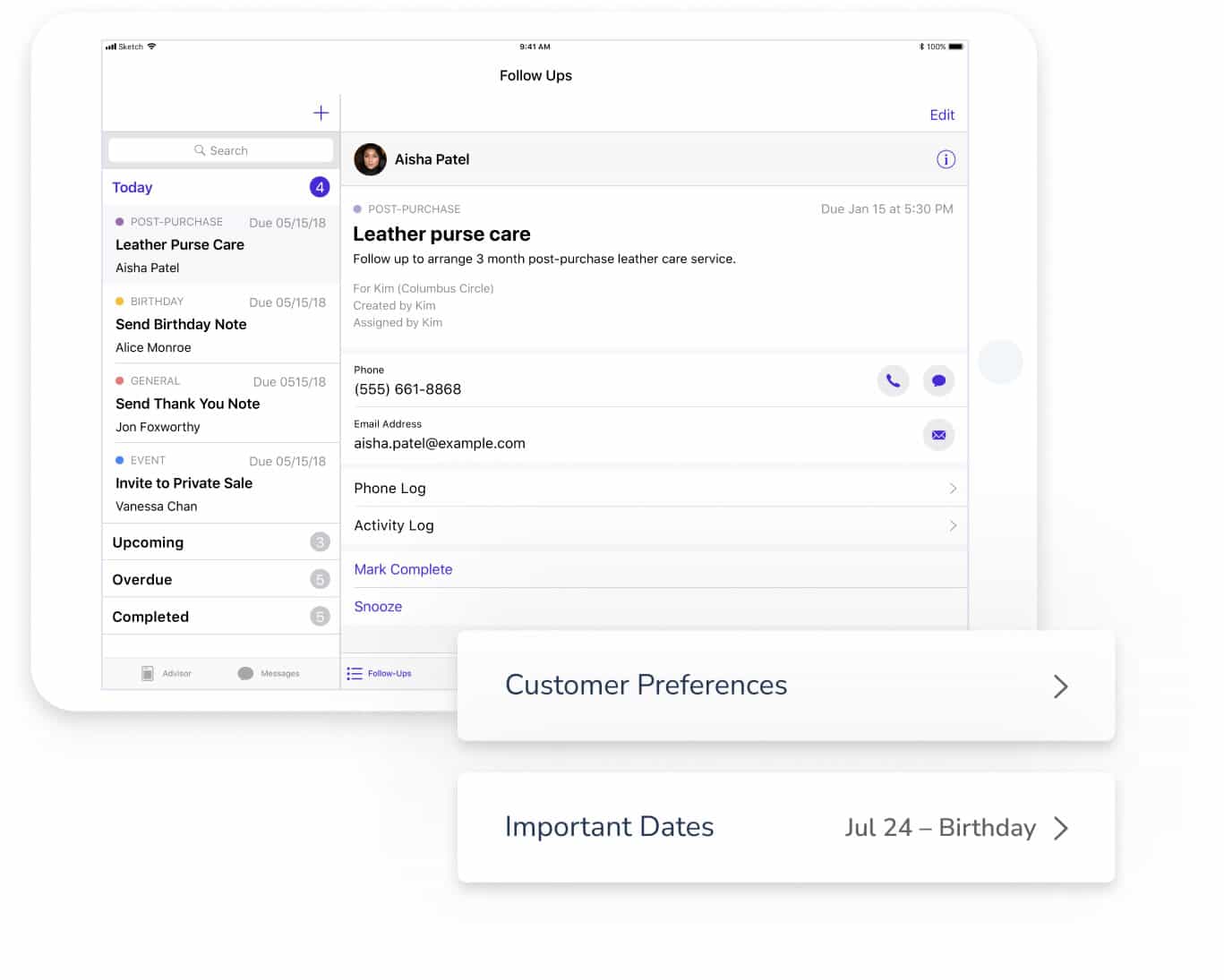

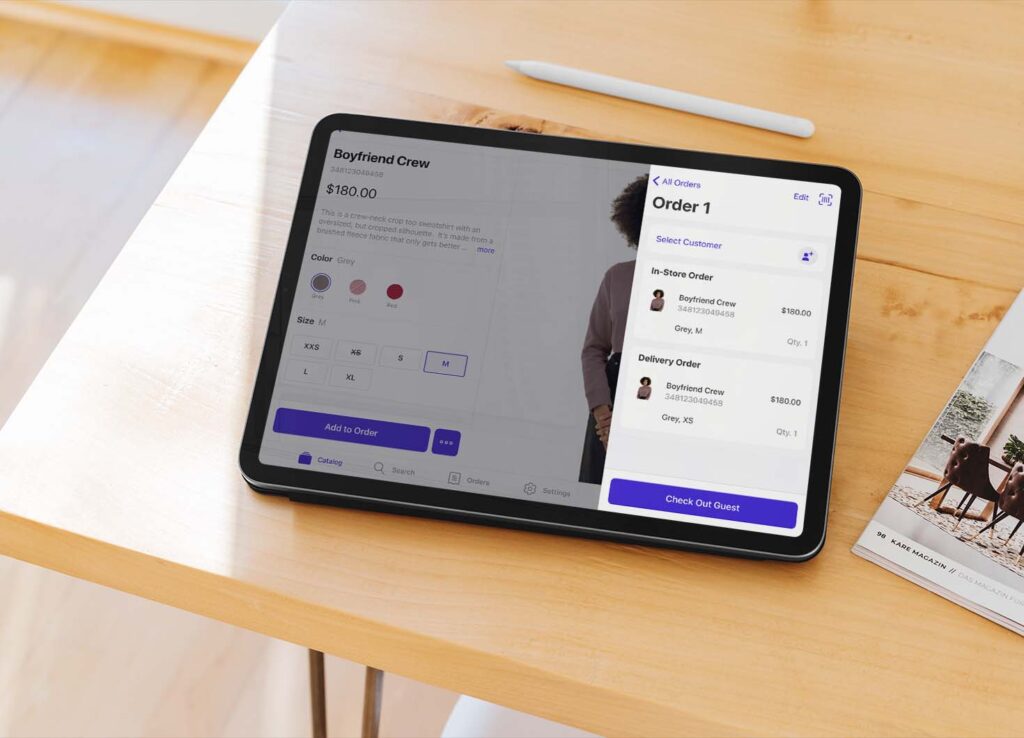

It’s no secret that the fixed till stands in the way of per square footage sales. Whether you’re looking to manage the holiday rush, provide a more comfortable end-to-end experience for 1:1 customers, or simply increase store conversions, Tulip’s mPOS lets associates step out from behind the cash register and checkout customers right from an iPad or iPhone.

Help associates handle high customer volumes efficiently and consistently

Features

- Line Busting Skip the checkout line and avoid the slow process of ringing up items while the customer waits with easy mobile checkout from anywhere in the store.

- Multi-basket Make the most of peak time by letting associates manage multiple active carts simultaneously and check each customer out at their own convenience.

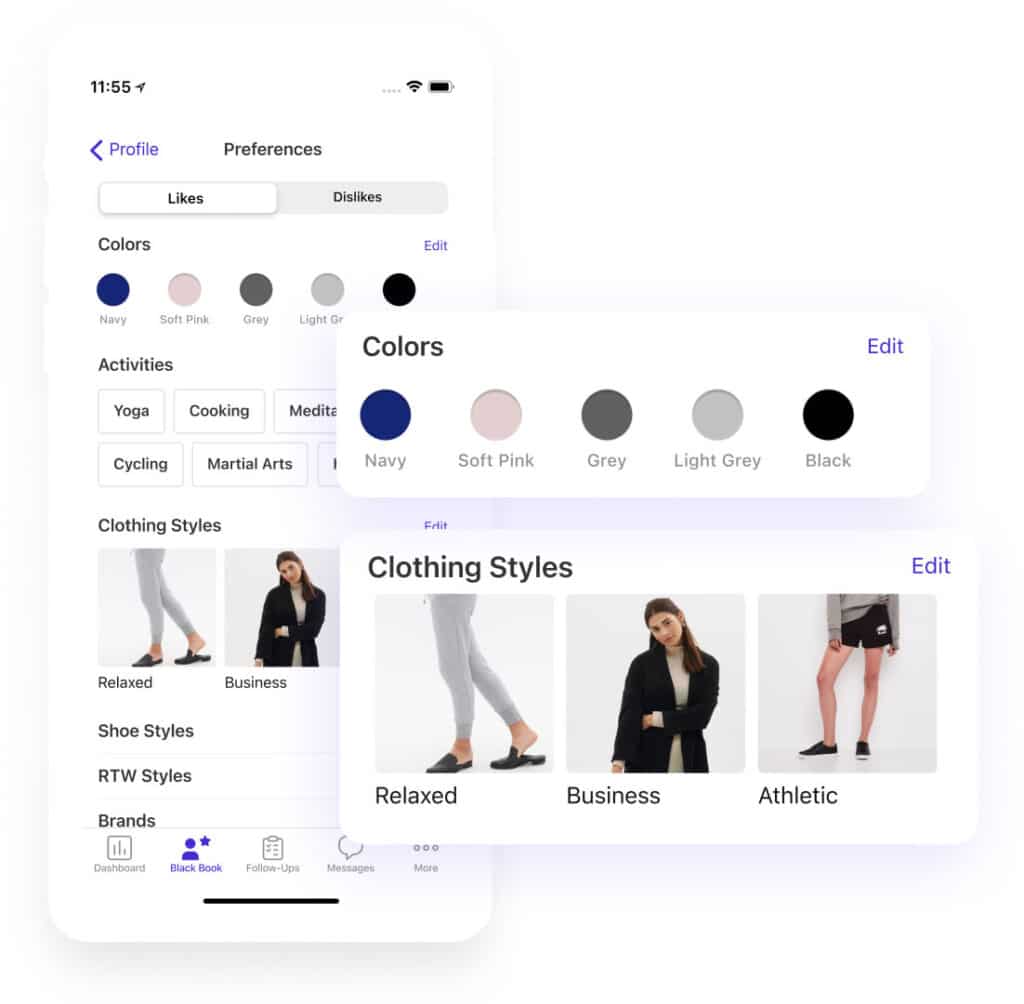

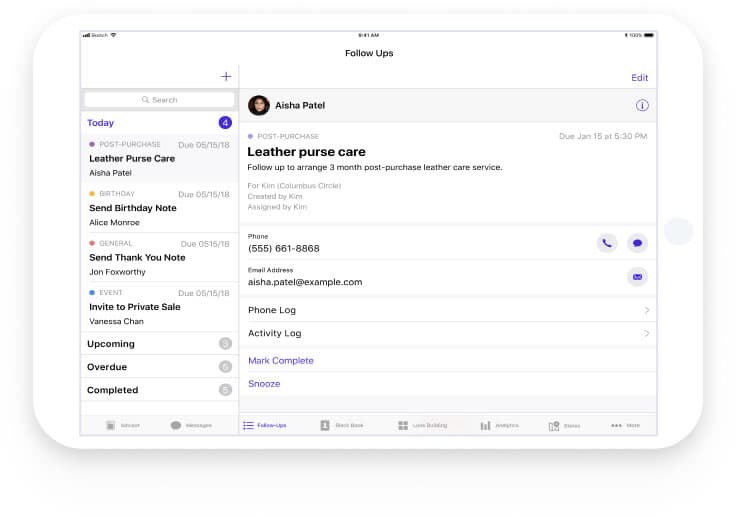

- Intuitive UI Get new associates up-to-speed almost instantly with an intuitive user interface that automates basic tasks and offers prompts to help provide a consistent customer experience.

Maximize store conversions with tools built to drive omnichannel sales

Features

- Omnichannel checkout Give associates one-touch access to inventory at other locations and online and enable them to checkout the customer’s full order in a single transaction, even if it’s a mixed basket.

- Pricing and promotion engine Price and promote products based on driving sales, not system limitations with support for complex discounts and pricing schemes like bundle pricing and location variations.

- Offline modeEvery minute of downtime means fewer sales, so it’s important that your mPOS is running even when your network isn’t. Offline mode lets store associates take sales, access the catalog, and operate business as usual without worrying about data loss or manual reconciliation to get back online.

Client Outcomes

Each number shows Tulip’s impact on one retailer’s business

45%

Increase in POS throughput capacity

17%

Increase in shopper NPS score

Speak to a Tulip rep today and see how we can help you.

45%

Increase in POS throughput capacity

17%

Increase in shopper NPS score

Speak to a Tulip rep today and see how we can help you.

mPOS vs. POS

There’s a fine line between the functionality of a full retail point of sale (POS) system and a mobile point of sale (mPOS) system . We believe that regardless of the path you select, your POS or mPOS system should provide reliable business operations and give customers a seamless experience. Where Tulip’s POS and mPOS differ is in terms of how they fit into your broader digital landscape.

mPOS

An mPOS system allows retailers to layer in the modern capabilities they need without replacing their entrenched POS as the system of record. This approach offers retailers a fast way to go live and start seeing benefits.

POS

A full POS system connects with the full suite of other retail systems and serves as the heart and lungs of the store. It provides retailers with fuller visibility and a simplified digital landscape in the long-term.

FAQ

FREQUENTLY ASKED QUESTIONS

mPOS basics

An mPOS (mobile point of sale) is a payment system that allows merchants to process card transactions using a smartphone or tablet and a card reader. It combines a mobile app and a reader, usually connected via Bluetooth or a charging port, to process transactions.

Mobile POS systems are often seen as a more flexible and cost-effective alternative to traditional point of sale (POS) terminals, as they do not require a fixed POS terminal or kiosk, and can be used in a variety of settings.

A mobile POS app is software to processes transactions using mobile devices like smartphones and tablets such as iPhones or iPads.

Benefits include improved customer experience, increased checkout efficiency, and enhanced security. Customers can pay with phones or payment methods like Apple Pay or Google Pay. Merchants can track sales data and access reports for business insights.

A mobile POS app streamlines checkout and provides a secure payment option.

Why choose mPOS technology

There are several benefits of using mobile POS (mPOS) solutions, including:

- Increased mobility and flexibility: With a mobile POS, employees can move around the store freely and serve customers in various areas, instead of being restricted to a fixed checkout counter.

- Reduced costs: mPOS systems are often more affordable than traditional POS terminals, as they do not require separate dedicated devices.

- Improved customer experience: mPOS systems allow merchants to process transactions quickly and efficiently, which can help reduce waiting times and improve the overall customer experience.

- Enhanced data management: mPOS systems often come with built-in data management tools that provide real-time insights into sales, transactions, and customer behavior.

- Enhanced security: mPOS systems often employ encryption technologies to secure customer data and comply with industry security standards.

Overall, mobile point of sale solutions offer a convenient and cost-effective way for businesses to process payments and manage their sales operations.

An mPOS (mobile point of sale) system can be a great asset to any retail business. It allows you to take payments quickly and securely, and can help streamline your checkout process. Additionally, mPOS systems are typically more cost-effective than traditional POS systems.

When deciding whether or not to purchase a mobile point of sale system, it is important to consider the needs of your business. If your biggest business focus is serving your customers, an mPOS system may be the best choice as it will allow you to serve them more efficiently.

Overall, a mobile POS system can be a great addition to any retail business and can help improve efficiency and reduce costs.

Mobile point of sale (mPOS) provide valuable solutions that:

- Improve checkout speed: mPOS systems can streamline the checkout process, making it quicker and more efficient for both the retailer and customer.

- Offer greater customer convenience: mPOS systems provide flexibility and allow customers to make purchases from anywhere in the store, leading to enhanced customer satisfaction.

- Track sales and inventory: mPOS solutions come equipped with powerful data tracking and reporting capabilities, allowing retailers to monitor sales, inventory levels, and customer behavior in real-time.

- Ensure data security: mPOS systems often use encryption technology to secure sensitive data, reducing the risk of fraud and data breaches.

- Increase mobility: mPOS solutions enable retailers to process transactions on-the-go, making it possible for them to set up pop-up shops or stay with customers through their entire shopping experience.

In conclusion, mobile POS systems can support a variety of retail needs and provide retailers with the tools they need to improve operations, enhance the customer experience, and gain valuable insights into their business.

Finding the right mPOS solution

When choosing an mPOS (mobile point of sale) system, you should consider the following factors:

- Compatibility: Ensure that the mPOS system is compatible with your mobile device, and that it supports the types of payments you need to accept, such as credit and debit cards, contactless payments, and mobile wallets.

- Security: Consider the security features of the mPOS system, including data encryption, fraud detection, and PCI (Payment Card Industry) compliance. Choose a system that employs the latest security technologies to protect customer data.

- Ease of use: Make sure the mPOS system has a user-friendly interface and clear instructions.

- Integration with existing systems: If you already use other business systems, such as an accounting or inventory management system, consider an mPOS system that integrates with those systems to streamline your workflow.

- Scalability: Choose an mPOS system that can grow with your business, and that provides the features and capabilities you need as your business expands.

- Offline capabilities: mPOS solutions with an offline mode can help protect your stores against network connectivity issues by allowing them to continue running even when the network is down.

By considering these factors, you can choose a mobile point of sale system that meets your specific needs and helps you run your business more efficiently.

Utilizing a unified POS system for both your mobile point of sale (mPOS) and brick-and-mortar store can bring several benefits to your business:

- It simplifies the inventory tracking process by allowing you to monitor stock levels and distribution between both platforms with ease.

- It enhances the customer experience by allowing for seamless returns and exchanges, as the same system will be used to process transactions in both environments.

- It enhances the customer experience by allowing for seamless omnichannel returns and exchanges, a return and exchange best practice, as the same system will be used to process transactions in both environments.

Mobile point of sale (mPOS) payments can be secure, but it’s important to choose a solution with robust security measures in place. One way to assess the security of an mPOS solution is to look for vendor compliance with widely recognized security standards such as PCI DSS or SOC 2.

Additionally, consider the mobile POS solution’s security features, such as encryption for sensitive data and real-time fraud detection. To ensure the safety of customer data, choose a mobile point of sale solution from a vendor that takes security seriously.

Getting Started

Interested in learning more about how we can help you get started on your next-gen mPOS journey?

Read more about our mPOS solutions and their features by downloading our brochure.

Still have questions? Contact us today — we’re happy to help!

We look forward to hearing from you!

Resources

Hear from the experts

The Store of the Future is now. We’ve curated some of the best resources that dive deeper into why hyper-personalization is the future of retail.

The 6 hidden costs of your legacy POS

The huge cost consumer is in need of some serious optimization POS systems are at the heart of store operations. ...

The ultimate guide to buying a retail POS

Choosing the point of sale with the functionality that’s right for your business In the current retail landscape, simply having ...